Introduction to financial modeling, Zdravka Aljinović

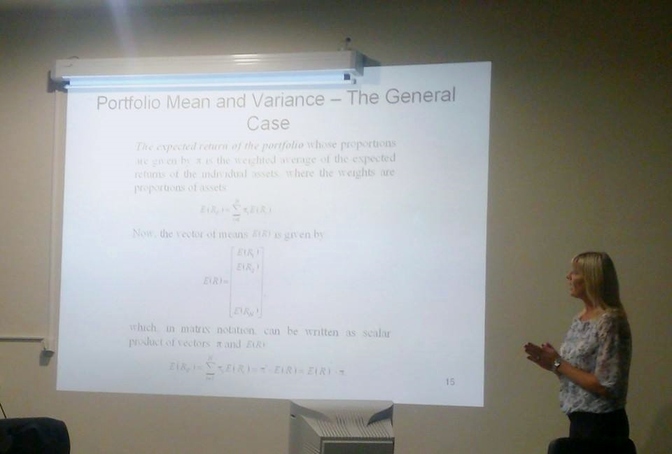

Prof. Zdravka Aljinović from University of Split gave us a lecture (30/9/2014) about basic portofolio optimization and Markowitz methods.

Introduction to financial modeling

- Basics of the Modern Portfolio Theory; Portfolio Mean and Variance, Calculating the Variance - Covariance Matrix.

- Theoretical framework of the Markowitz’ model, the minimum variance set, efficient portfolio, efficient frontier - short sale allowed, efficient frontier without short sale.

- Is Variance a proper risk measure? - An Alternative Risk Measures.

- CAPM, beta, testing CAPM.

- Demonstration and Calculation in Excel.

Please find attached the material of the lecture.